Property Tax Rate For Riverside County: A Deep Dive Into What You Need To Know

Property taxes are one of those things that can feel like a mystery wrapped in an enigma. If you're living in or planning to move to Riverside County, understanding the property tax rate is crucial. Whether you're a homeowner, investor, or just curious about the financial side of living in this beautiful part of California, this article has got you covered. Let’s break it down in a way that’s easy to digest and actually makes sense.

Let’s be real, nobody loves paying taxes, but they’re a part of life. And when it comes to property taxes in Riverside County, there’s a lot to unpack. From how the rates are calculated to what factors influence them, we’ll dive into everything you need to know. Riverside County is known for its diverse communities, stunning landscapes, and a growing economy, but it also comes with its own set of tax rules that you should be aware of.

In this guide, we’ll explore the ins and outs of property tax rates in Riverside County. We’ll cover the basics, break down the numbers, and give you actionable insights so you’re not left scratching your head at tax time. So, grab a coffee, sit back, and let’s get into it!

Read also:Port Huron Times Herald Obituaries A Comprehensive Guide To Understanding The Legacy

Understanding Property Tax Basics in Riverside County

First things first, what exactly is a property tax? Simply put, it’s a tax levied on real estate based on its assessed value. In Riverside County, property taxes are calculated using a combination of factors, including the property’s assessed value, tax rates, and any additional assessments. The property tax rate for Riverside County typically hovers around 1% of the assessed value, but there’s more to it than that.

How Are Property Taxes Calculated?

Here’s where it gets interesting. The assessed value of your property is determined by the county assessor, who looks at factors like location, size, and improvements. Once the value is established, the tax rate is applied. For Riverside County, the base rate is 1%, but additional assessments for things like school bonds or infrastructure improvements can bump that number up. So, if your property is assessed at $500,000, your base tax would be $5,000, but add-ons could push it higher.

Let’s break it down in simpler terms:

- Assessed Value: The official value of your property as determined by the county.

- Tax Rate: Typically 1%, but additional assessments can increase this.

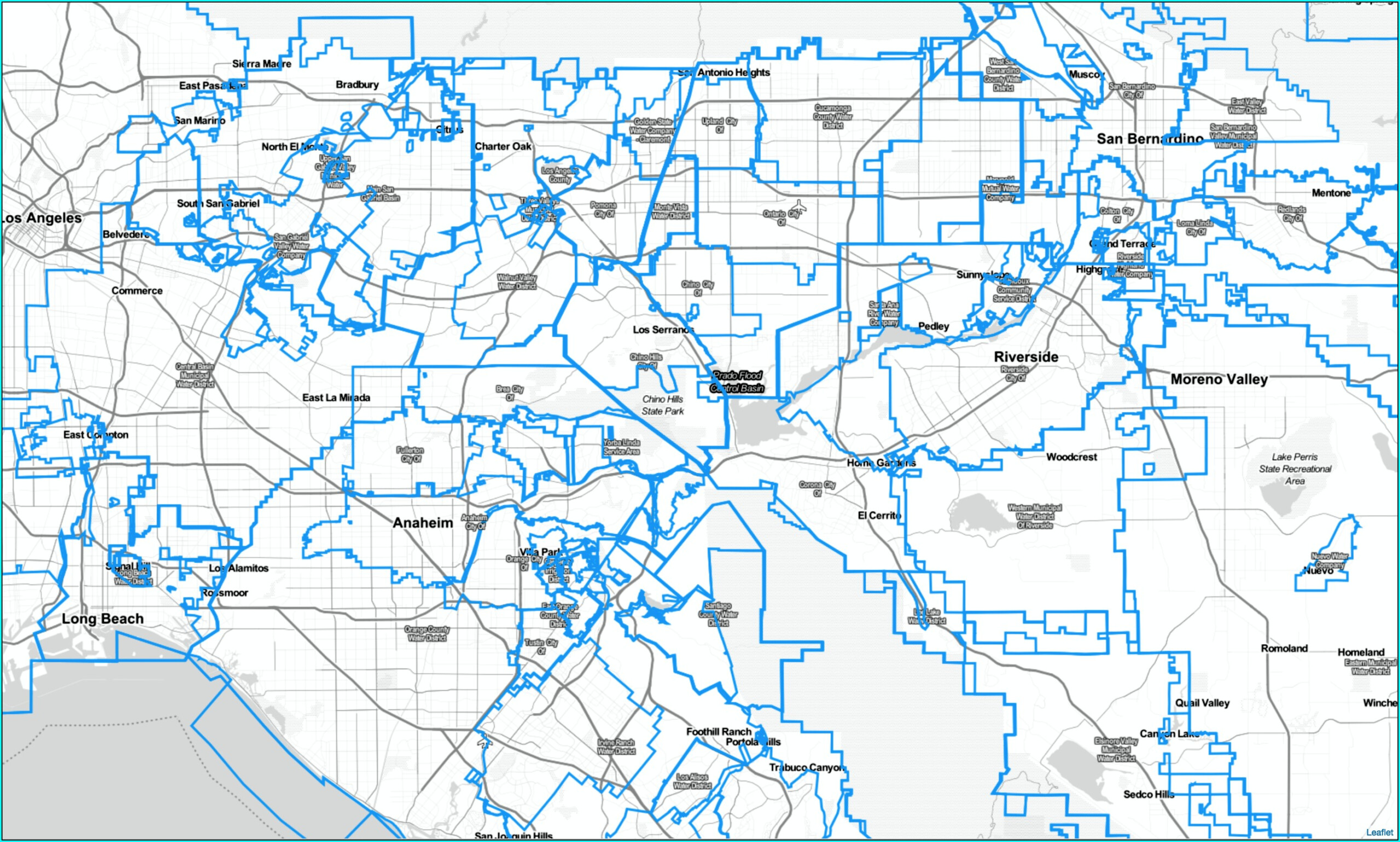

- Additional Assessments: These could include things like school bonds, water districts, or special fees.

Key Factors Influencing Property Tax Rates

Now that we’ve got the basics down, let’s talk about what influences those rates. Several factors come into play when determining your property tax bill in Riverside County. Location is a big one—properties in more urban areas might have different rates compared to those in rural areas. Additionally, the age of your property, any renovations or upgrades, and even market trends can affect your tax rate.

Location, Location, Location

Where your property is located within Riverside County can make a big difference. For example, properties in Temecula or Murrieta might have different tax rates compared to those in Blythe or Desert Hot Springs. Urban areas often have higher rates due to increased services and infrastructure needs. On the flip side, rural areas might have lower rates but fewer services.

The Role of Proposition 13

Proposition 13, passed in 1978, is a game-changer when it comes to property taxes in California. It limits the amount property taxes can increase each year to 2% of the assessed value. This means that even if your property’s market value skyrockets, your tax bill won’t increase at the same rate. It’s a protection for homeowners, especially in areas like Riverside County where property values have been on the rise.

Read also:Unpacking The Hilarity Snl March Madness Bracket Skit Reimagined

How Proposition 13 Affects Riverside County

In Riverside County, Proposition 13 has had a significant impact. For long-time homeowners, it means their tax bills remain relatively stable even as property values increase. However, for new buyers, the assessed value is often higher, leading to potentially higher tax bills. It’s a double-edged sword, but one that provides stability for many residents.

Property Tax Exemptions and Deductions

Here’s some good news: there are exemptions and deductions available that can help lower your property tax bill. The most common is the homeowner’s exemption, which reduces the assessed value of your primary residence by $7,000. There are also exemptions for seniors, disabled individuals, and those who have suffered a natural disaster. Don’t forget to check if you qualify for any of these!

Claiming Exemptions and Deductions

To claim these exemptions, you’ll need to file the appropriate paperwork with the Riverside County Assessor’s Office. It’s a straightforward process, but deadlines are important, so make sure you don’t miss them. For example, the deadline for filing a homeowner’s exemption is typically February 15th of each year.

Appealing Your Property Tax Assessment

If you think your property tax assessment is too high, you have the right to appeal. The process involves submitting a formal request to the Assessor’s Office and providing evidence to support your claim. This could include comparable sales data, property condition reports, or other relevant information. Appealing isn’t always easy, but it can be worth it if you believe your assessment is inaccurate.

Steps to Appeal Your Assessment

Here’s a quick rundown of the steps:

- Review your assessment notice carefully.

- Gather evidence to support your claim.

- Submit your appeal to the Assessor’s Office.

- Attend a hearing if necessary.

Property Tax Trends in Riverside County

Over the years, property tax trends in Riverside County have shown both stability and growth. As the county continues to develop, property values have generally increased, leading to higher tax bills for some homeowners. However, thanks to Proposition 13, the increases have been manageable for many residents. Keeping an eye on these trends can help you plan for the future and make informed financial decisions.

What the Future Holds

Looking ahead, it’s likely that property values in Riverside County will continue to rise, especially in popular areas like Temecula and Murrieta. This could mean higher assessments and, consequently, higher tax bills. However, as long as Proposition 13 remains in effect, the increases should remain within reasonable limits. Staying informed and proactive is key to managing your property taxes effectively.

Comparing Riverside County to Other Counties

How does Riverside County stack up against other counties in California? In terms of property tax rates, Riverside County is fairly typical, with the base rate of 1% and additional assessments varying by location. However, when compared to counties like Los Angeles or San Francisco, Riverside County tends to have lower property values, which can result in lower overall tax bills. It’s always a good idea to compare rates if you’re considering a move.

Key Differences to Note

While the base tax rate is similar across California, the additional assessments can vary widely. In Riverside County, you might see fees for school bonds or water districts, whereas in other counties, you might encounter different types of assessments. Understanding these differences can help you make a more informed decision about where to buy or invest.

Resources for Further Information

If you want to dig deeper into property tax rates for Riverside County, there are several resources available. The Riverside County Assessor’s Office website is a great place to start, offering detailed information on assessments, exemptions, and appeals. Additionally, local real estate agents and tax professionals can provide valuable insights and advice.

Where to Find Reliable Data

For the most accurate and up-to-date information, check out:

- Riverside County Assessor’s Office

- California State Board of Equalization

- Local real estate agencies

Final Thoughts and Call to Action

Property taxes in Riverside County might seem complex, but with a little knowledge and preparation, they don’t have to be overwhelming. Understanding the basics, knowing your rights, and staying informed can help you manage your tax bill effectively. Whether you’re a homeowner, investor, or just curious about the financial side of living in Riverside County, this guide has provided you with the tools you need to succeed.

So, what’s next? Take action! Check your property assessment, see if you qualify for any exemptions, and stay on top of trends in your area. And don’t forget to share this article with friends or family who might find it helpful. Together, we can all navigate the world of property taxes with confidence.

Property tax rate for Riverside County doesn’t have to be a mystery anymore. With the right information, you’re ready to take control of your finances and make smart decisions about your property.

Table of Contents

- Understanding Property Tax Basics in Riverside County

- How Are Property Taxes Calculated?

- Key Factors Influencing Property Tax Rates

- Location, Location, Location

- The Role of Proposition 13

- Property Tax Exemptions and Deductions

- Appealing Your Property Tax Assessment

- Property Tax Trends in Riverside County

- Comparing Riverside County to Other Counties

- Resources for Further Information