Understanding Walmart Spark Driver Taxes: A Comprehensive Guide

Walmart Spark drivers play a crucial role in the retail giant's supply chain, ensuring that stores are stocked with the products customers need. However, understanding the intricacies of Walmart Spark driver taxes can be a challenge for many. This article dives deep into the tax obligations, deductions, and strategies that can help drivers navigate this complex area. Whether you're a new driver or a seasoned professional, this guide aims to provide clarity and actionable insights to optimize your financial planning.

Taxes for Walmart Spark drivers encompass various aspects, from federal and state obligations to potential deductions that can reduce your taxable income. As the gig economy continues to grow, understanding these nuances becomes even more critical. This article not only breaks down the essential elements of Walmart Spark driver taxes but also offers practical advice to help drivers make informed decisions.

As we explore the world of Walmart Spark driver taxes, it's important to recognize the evolving landscape of tax regulations and how they impact drivers. Staying up-to-date with the latest changes can help ensure compliance and maximize savings. By the end of this article, you'll have a clearer understanding of the tax landscape and how to navigate it effectively.

Read also:Exploring The Vibrant Regal Simi Valley Civic Center A Hub For Community And Entertainment

What Are Walmart Spark Driver Taxes?

Walmart Spark driver taxes refer to the tax obligations that drivers face as part of their role in delivering goods to Walmart stores. These taxes can vary depending on several factors, including the driver's classification (employee vs. contractor), location, and specific job duties. Understanding the distinction between employee and contractor status is crucial, as it directly impacts the types of taxes you'll need to pay and the deductions you can claim.

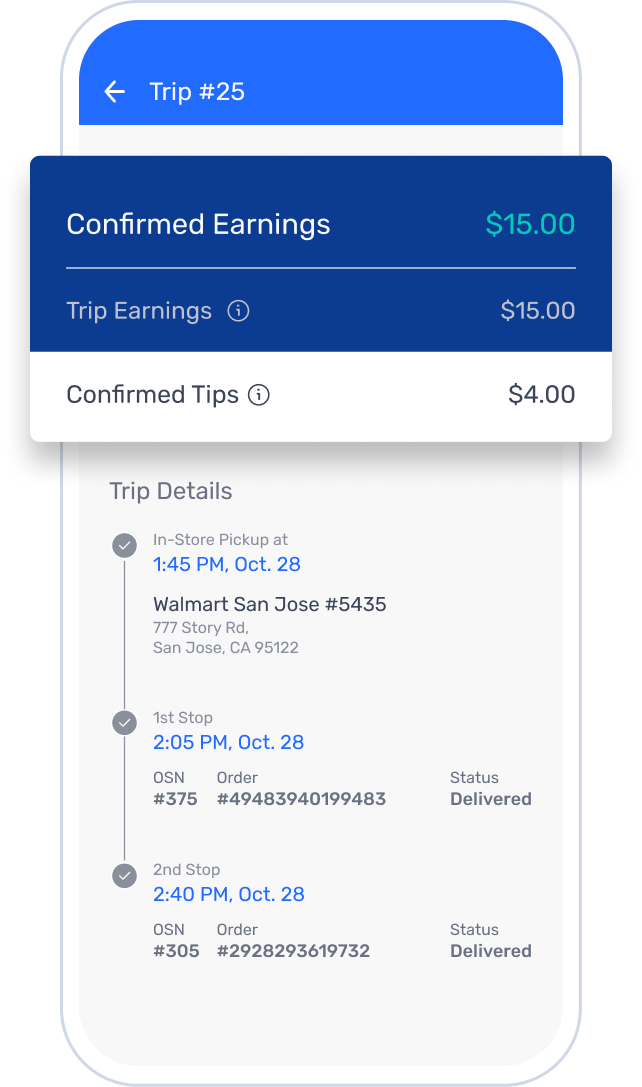

How Do Walmart Spark Drivers Get Paid?

Before diving into the specifics of Walmart Spark driver taxes, it's essential to understand how drivers are compensated. Walmart employs various payment models, depending on the nature of the job and the driver's classification. For employees, wages are typically subject to standard payroll taxes, while contractors may receive payments that require additional tax considerations. This section will break down the payment structures and their tax implications.

Can Walmart Spark Drivers Deduct Expenses?

One of the most common questions among Walmart Spark drivers is whether they can deduct expenses related to their job. The answer depends on the driver's employment classification. Employees may have limited options for deductions, while contractors can claim a broader range of expenses. This section will explore the types of expenses that may qualify for deductions and provide examples to illustrate the process.

Why Is Understanding Walmart Spark Driver Taxes Important?

For many Walmart Spark drivers, understanding their tax obligations is crucial for financial stability and long-term planning. Misunderstanding or mismanaging taxes can lead to penalties, audits, or missed opportunities for savings. By gaining a deeper understanding of Walmart Spark driver taxes, drivers can make informed decisions that benefit both their personal finances and their careers.

- Minimize tax liabilities

- Avoid costly penalties

- Maximize deductions and credits

What Are the Common Mistakes Walmart Spark Drivers Make with Taxes?

Even experienced drivers can fall into common tax pitfalls. Some of the most frequent mistakes include failing to track expenses, underestimating tax obligations, or not understanding the differences between employee and contractor status. This section will highlight these mistakes and provide actionable tips to avoid them.

How Can Walmart Spark Drivers Prepare for Tax Season?

Proper preparation is key to successfully navigating tax season. Walmart Spark drivers should start by gathering all necessary documentation, such as income statements, expense receipts, and mileage logs. This section will provide a step-by-step guide to help drivers organize their records and streamline the tax filing process.

Read also:Time Cover Of Kamala A Historic Milestone For Representation And Leadership

Key Aspects of Walmart Spark Driver Taxes

To fully grasp the complexities of Walmart Spark driver taxes, it's important to examine the key aspects that influence tax obligations. These include federal and state tax rates, potential deductions, and credits that drivers may qualify for. By understanding these elements, drivers can develop a comprehensive tax strategy that aligns with their financial goals.

What Are the Tax Deductions Available for Walmart Spark Drivers?

Drivers often incur various expenses while performing their duties, and many of these expenses can be deducted from taxable income. Common deductions include vehicle maintenance, fuel costs, tolls, and uniform expenses. This section will delve into the specifics of these deductions and explain how drivers can claim them effectively.

How Do State Taxes Affect Walmart Spark Drivers?

State taxes can vary significantly depending on the driver's location and the states they operate in. Some states impose additional taxes or offer unique deductions that drivers should be aware of. This section will explore the impact of state taxes on Walmart Spark drivers and provide guidance on navigating these variations.

Strategies for Managing Walmart Spark Driver Taxes

Effectively managing Walmart Spark driver taxes requires a combination of planning, organization, and awareness of available resources. Drivers can take advantage of tools such as tax software, professional advice, and educational resources to simplify the process. This section will outline practical strategies that drivers can implement to optimize their tax management.

Can Walmart Spark Drivers Use Tax Software?

Tax software can be a valuable tool for Walmart Spark drivers, offering features such as expense tracking, deduction calculations, and form preparation. This section will discuss the benefits of using tax software and recommend options that are well-suited for drivers.

How Can Drivers Stay Informed About Changes in Walmart Spark Driver Taxes?

Tax regulations are subject to change, and staying informed is essential for compliance and financial planning. Drivers can subscribe to newsletters, attend webinars, and follow credible sources to stay updated on the latest developments. This section will provide resources and tips for staying informed about Walmart Spark driver taxes.

Conclusion

In conclusion, understanding Walmart Spark driver taxes is a critical component of financial success for drivers. By familiarizing themselves with tax obligations, deductions, and strategies, drivers can make informed decisions that benefit their careers and personal finances. This article has provided a comprehensive overview of the key aspects of Walmart Spark driver taxes, equipping drivers with the knowledge and tools needed to navigate this complex area effectively.

Table of Contents

- Understanding Walmart Spark Driver Taxes: A Comprehensive Guide

- What Are Walmart Spark Driver Taxes?

- How Do Walmart Spark Drivers Get Paid?

- Can Walmart Spark Drivers Deduct Expenses?

- Why Is Understanding Walmart Spark Driver Taxes Important?

- What Are the Common Mistakes Walmart Spark Drivers Make with Taxes?

- How Can Walmart Spark Drivers Prepare for Tax Season?

- Key Aspects of Walmart Spark Driver Taxes

- What Are the Tax Deductions Available for Walmart Spark Drivers?

- How Do State Taxes Affect Walmart Spark Drivers?

- Strategies for Managing Walmart Spark Driver Taxes

- Can Walmart Spark Drivers Use Tax Software?

- How Can Drivers Stay Informed About Changes in Walmart Spark Driver Taxes?

- Conclusion