Ochsner Workday Pay: The Ultimate Guide To Understanding Your Payroll

Let’s talk about something that really hits home for employees at Ochsner Health – your paycheck. If you're one of the thousands of workers relying on Ochsner Workday Pay, you know how important it is to understand how this system works. But let's be real, payroll systems can sometimes feel like a maze of numbers and jargon. Don’t worry, we’ve got you covered.

Picture this: it's payday, and you’re eagerly waiting to see that deposit hit your account. But what if there’s a discrepancy? Or worse, you don’t even know where to start when it comes to understanding your payslip? That’s where this guide comes in. We’re here to break down everything you need to know about Ochsner Workday Pay, from how it works to troubleshooting common issues.

Whether you're new to Ochsner or you've been around for a while, staying informed about your compensation is key. So grab a coffee, sit back, and let’s dive into the world of Ochsner Workday Pay. Your financial health depends on it, and we’re here to make sure you’re in the know.

Read also:Unveiling The Urban Lingo What Does Chopped Cheese Mean In Slang

What is Ochsner Workday Pay?

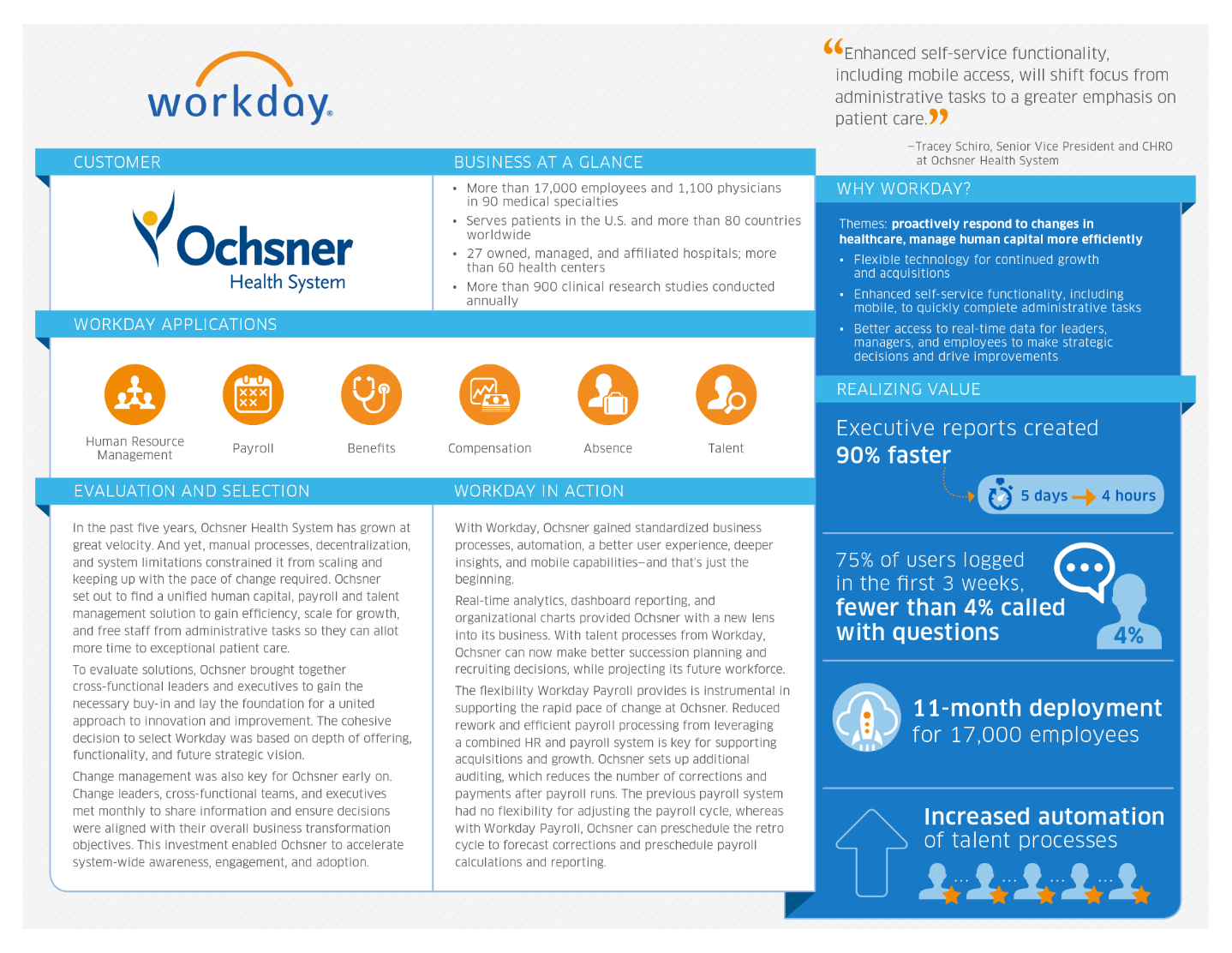

First things first, let’s define what we’re dealing with here. Ochsner Workday Pay is part of the larger Workday platform, which is a cloud-based system designed to streamline payroll, HR, and financial management processes. Think of it as the digital backbone of how Ochsner handles employee payments, benefits, and more.

This system allows employees to access their pay information securely online. From viewing pay stubs to managing direct deposits, Workday Pay makes managing your finances easier and more transparent. And hey, who doesn’t love a little transparency when it comes to money, right?

Why is Workday Pay Important?

Here’s the thing: payroll isn’t just about getting paid. It’s about accuracy, security, and convenience. Workday Pay ensures that all your payment details are up-to-date and secure. Plus, it gives you the power to manage your financial information anytime, anywhere.

Imagine being able to adjust your direct deposit splits or view your tax withholdings without needing to visit HR in person. That’s the beauty of Workday Pay. It puts control back in your hands, making your life a little less stressful.

How Does Ochsner Workday Pay Work?

Now that we’ve covered the basics, let’s dive into the nitty-gritty of how Ochsner Workday Pay functions. Here’s a quick rundown:

- Accessing Your Account: To access Workday Pay, simply log in to the Ochsner Workday portal using your credentials. It’s as easy as pie.

- Viewing Pay Stubs: Once logged in, you can view your pay stubs from the ‘Pay’ section. This includes all the details you’d expect, like gross pay, deductions, and net pay.

- Managing Direct Deposits: Need to change your direct deposit settings? No problem. You can do this directly through the platform. Whether you want to split your deposits between multiple accounts or update your bank info, it’s all possible.

And the best part? All these features are designed with user-friendliness in mind. No more sifting through paperwork or waiting for HR to update your info. You’re in charge.

Read also:Ruks Uncut The Ultimate Guide To Understanding And Exploring Its Meaning

Setting Up Direct Deposit in Workday Pay

Direct deposit is one of the most convenient features of Ochsner Workday Pay. Here’s how you can set it up:

- Log in to your Workday account.

- Go to the ‘Pay’ section.

- Select ‘Direct Deposit’ from the options.

- Enter your bank account information, including routing and account numbers.

- Save your changes, and you’re good to go!

Simple, right? With direct deposit, you’ll never have to worry about missing a paycheck again. Your money will be right where it needs to be on payday.

Understanding Your Pay Stub

Your pay stub is more than just a record of how much you earned. It’s a detailed breakdown of your compensation, deductions, and taxes. Let’s break it down:

- Gross Pay: This is your total earnings before any deductions.

- Deductions: Includes things like taxes, insurance premiums, and retirement contributions.

- Net Pay: The amount you actually take home after all deductions.

It’s important to review your pay stub regularly to ensure everything is accurate. If you notice any discrepancies, don’t hesitate to reach out to HR. Your money matters, and so does the accuracy of your pay stub.

Common Deductions on Your Pay Stub

Here are some common deductions you might see on your pay stub:

- Federal and state taxes

- Social Security and Medicare contributions

- Health insurance premiums

- Retirement plan contributions

Understanding these deductions can help you better manage your finances. Plus, it’s always good to know where your money is going.

Troubleshooting Common Issues

Even the best systems can have hiccups. Here are some common issues employees might encounter with Ochsner Workday Pay and how to fix them:

- Forgot Your Password? No worries. Use the ‘Forgot Password’ feature to reset it.

- Pay Stub Not Showing Up? Double-check your email or contact HR if the issue persists.

- Direct Deposit Not Working? Verify your bank account information and ensure it’s updated in the system.

If you’re still stuck, don’t hesitate to reach out to Ochsner’s HR support team. They’re there to help you navigate any issues you might face.

When to Contact HR

There are times when you might need to reach out to HR for assistance. Here are a few scenarios:

- Your pay stub shows incorrect information.

- You’re having trouble logging into your Workday account.

- You need to update your personal information.

Remember, HR is your ally in these situations. They’re there to ensure everything runs smoothly for you.

Tips for Maximizing Your Ochsner Workday Pay

Now that you understand how Ochsner Workday Pay works, here are some tips to help you make the most of it:

- Review Your Pay Stub Regularly: This helps you catch any errors early on.

- Set Up Direct Deposit: It’s faster and more secure than paper checks.

- Take Advantage of Employee Benefits: From retirement plans to insurance, these benefits can significantly impact your overall compensation.

By taking these steps, you’ll not only streamline your payroll process but also ensure you’re getting the most out of your employment at Ochsner.

Understanding Employee Benefits

Employee benefits are a crucial part of your compensation package. Here’s a quick look at what Ochsner offers:

- Health, dental, and vision insurance

- Retirement savings plans

- Paid time off and holidays

Make sure you’re fully utilizing these benefits. They’re there to support you both professionally and personally.

Data Security in Ochsner Workday Pay

Data security is a top priority for Ochsner Workday Pay. The platform uses advanced encryption and security protocols to protect your sensitive information. But what does this mean for you?

It means you can access your payroll information with peace of mind, knowing that your data is safe and secure. Workday is committed to maintaining the highest standards of security, ensuring that your personal and financial information remains confidential.

Best Practices for Keeping Your Account Secure

Here are some tips to keep your Ochsner Workday Pay account secure:

- Use a strong, unique password.

- Enable two-factor authentication if available.

- Log out of your account when using a shared device.

By following these best practices, you’ll help protect your account from unauthorized access.

Conclusion

So there you have it – everything you need to know about Ochsner Workday Pay. From understanding your pay stub to troubleshooting common issues, this guide has you covered. Remember, your paycheck is more than just a number. It’s a reflection of your hard work and dedication.

We encourage you to take full advantage of the features offered by Workday Pay. Whether it’s setting up direct deposit or managing your benefits, staying informed and proactive is key. And if you ever have questions or concerns, don’t hesitate to reach out to HR.

Now it’s your turn. Share this article with your colleagues, leave a comment with your thoughts, or explore other resources on our site. Together, let’s make managing your finances a little easier and a lot more transparent.

Table of Contents

- What is Ochsner Workday Pay?

- Why is Workday Pay Important?

- How Does Ochsner Workday Pay Work?

- Setting Up Direct Deposit in Workday Pay

- Understanding Your Pay Stub

- Common Deductions on Your Pay Stub

- Troubleshooting Common Issues

- When to Contact HR

- Tips for Maximizing Your Ochsner Workday Pay

- Understanding Employee Benefits

- Data Security in Ochsner Workday Pay

- Best Practices for Keeping Your Account Secure