Who Accepts Sezzle Virtual Card: A Comprehensive Guide For Smart Shoppers

Shopping has never been easier, but have you ever wondered who accepts Sezzle virtual card? The payment landscape is evolving rapidly, and Sezzle is leading the charge with its innovative "buy now, pay later" (BNPL) solution. Whether you're a seasoned online shopper or just starting out, understanding where and how to use your Sezzle virtual card can unlock a world of possibilities. So, buckle up and let's dive into the details!

Sezzle virtual card is more than just another payment method; it's a game-changer for those who want flexibility without the stress of traditional credit cards. By breaking down purchases into manageable installments, Sezzle empowers consumers to shop smarter and more responsibly. But the big question remains—where exactly can you use this revolutionary tool?

In this article, we'll explore the ins and outs of Sezzle virtual card acceptance, including which retailers support it, how to use it seamlessly, and why it's becoming a favorite among shoppers worldwide. Whether you're buying fashion, electronics, or even groceries, you'll find everything you need to know right here.

Read also:Cne Consulta Ve A Comprehensive Guide To Vehicle Verification In Venezuela

Table of Contents:

- What is Sezzle?

- How Does Sezzle Work?

- Who Accepts Sezzle Virtual Card?

- Top Online Retailers That Accept Sezzle

- Physical Stores Supporting Sezzle

- Using Sezzle Internationally

- Benefits of Using Sezzle Virtual Card

- Eligibility Requirements

- Tips for Maximizing Your Sezzle Experience

- The Future of Sezzle

What is Sezzle?

Sezzle is a BNPL platform that allows shoppers to split their purchases into interest-free installments over time. Unlike traditional credit cards, Sezzle doesn't charge interest or fees, making it an attractive option for budget-conscious consumers. It works by generating a virtual card number that you can use anywhere Visa or Mastercard is accepted.

But what makes Sezzle stand out? The platform emphasizes transparency and financial responsibility, ensuring users only spend what they can afford. Plus, with no impact on your credit score, Sezzle offers a guilt-free shopping experience.

How Does Sezzle Work?

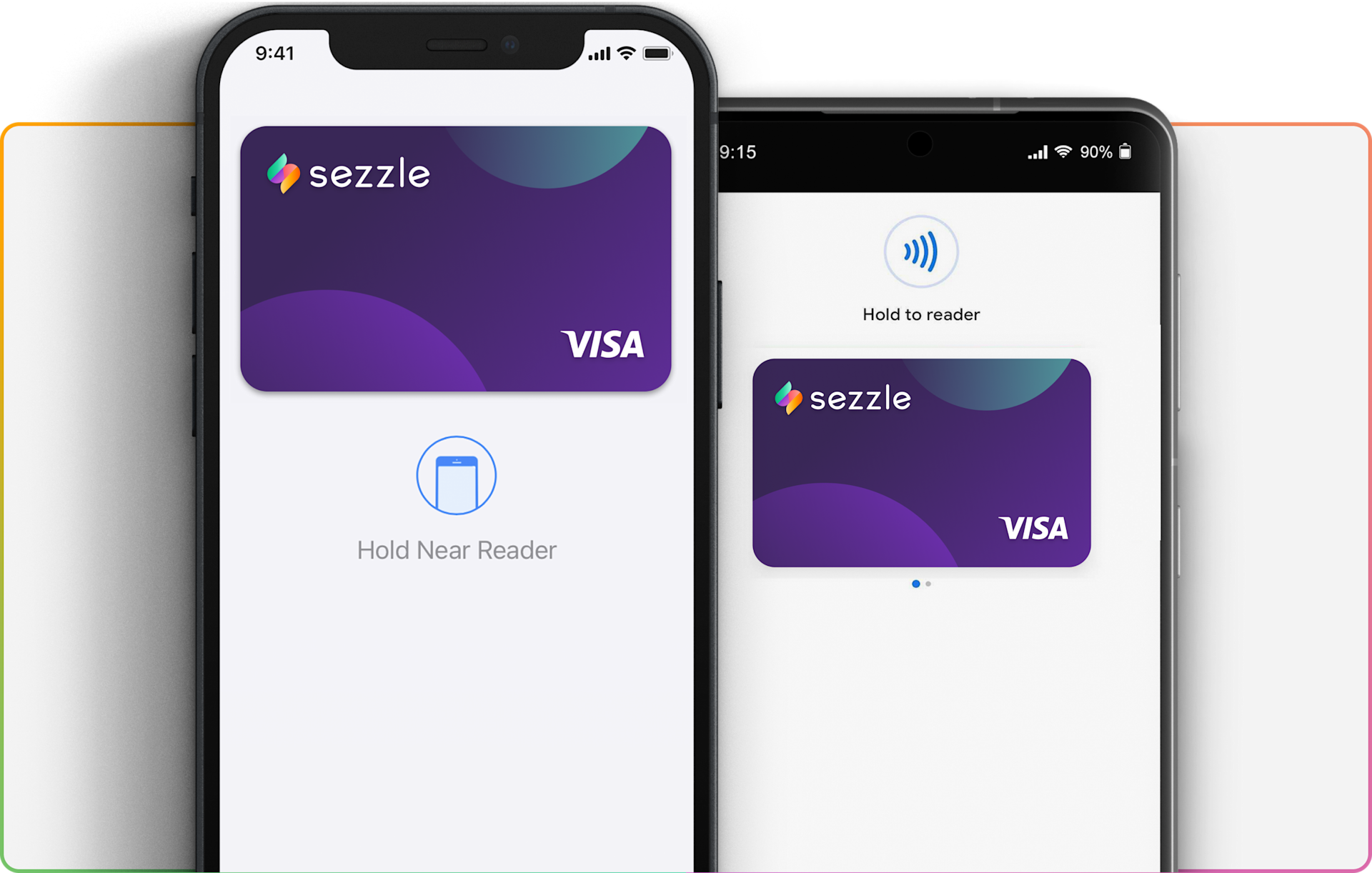

Using Sezzle is as simple as pie. Once you sign up for an account, you'll gain access to a virtual card that you can use for online and in-store purchases. Here's a quick breakdown:

- Select your desired item from a participating retailer.

- At checkout, choose Sezzle as your payment method.

- Enter your Sezzle virtual card details or scan the QR code if shopping in-store.

- Your purchase will be split into four equal payments, spread out over six weeks.

It's that easy! Plus, you'll receive reminders for each payment, so you never miss a deadline.

Who Accepts Sezzle Virtual Card?

This is the million-dollar question, isn't it? The good news is that Sezzle is widely accepted across a variety of industries, from fashion and beauty to tech and travel. As long as a merchant accepts Visa or Mastercard, chances are high that Sezzle will work seamlessly.

Read also:What Is The Legal Age To Drink Alcohol In France And Why Does It Matter

Key Industries Supporting Sezzle

Sezzle's reach extends far and wide, catering to almost every shopping need. Below are some of the key industries where you can use your virtual card:

- Fashion & Apparel: From high-end designers to budget-friendly brands, Sezzle has got you covered.

- Electronics: Need a new phone or laptop? Many tech retailers now accept Sezzle.

- Home Goods: Transform your living space without breaking the bank.

- Beauty & Wellness: Pamper yourself with beauty products and wellness essentials.

Top Online Retailers That Accept Sezzle

When it comes to online shopping, Sezzle has partnered with some of the biggest names in e-commerce. Here are a few popular retailers where you can use your virtual card:

- ASOS

- Urban Outfitters

- Nike

- Adidas

- Target

- Best Buy

Keep in mind that the list is constantly growing, so always check the Sezzle website for the latest updates.

Physical Stores Supporting Sezzle

While Sezzle started as an online payment solution, it's now making waves in the brick-and-mortar world. Many physical stores now accept Sezzle through its virtual card feature. Simply present your virtual card details at checkout, and you're good to go!

Some popular physical stores include:

- Macy's

- Walmart

- Foot Locker

- H&M

It's worth noting that not all locations may support Sezzle, so it's always a good idea to confirm before heading out.

Using Sezzle Internationally

Sezzle's global expansion means you can now use your virtual card in countries beyond the U.S. While the exact list of supported regions varies, Sezzle continues to add new partners worldwide. If you're planning an international trip, check the Sezzle app for updates on cross-border acceptance.

Things to Consider When Using Sezzle Abroad

While Sezzle is widely accepted internationally, there are a few things to keep in mind:

- Exchange rates may apply depending on the currency used.

- Some merchants may require additional verification steps.

- Always double-check the retailer's payment policies to avoid any surprises.

Benefits of Using Sezzle Virtual Card

So, why should you choose Sezzle over other payment methods? Here are a few compelling reasons:

- No Interest Fees: Say goodbye to hidden charges and enjoy interest-free payments.

- Flexible Payments: Split your purchases into manageable installments.

- Secure Transactions: Sezzle uses top-tier encryption to protect your data.

- No Credit Impact: Shopping with Sezzle won't affect your credit score.

These benefits make Sezzle a top choice for savvy shoppers looking to optimize their spending.

Eligibility Requirements

Before diving into the Sezzle world, it's important to understand the eligibility criteria. While the process is straightforward, there are a few prerequisites:

- Be at least 18 years old (age requirements may vary by country).

- Have a valid email address and phone number for account verification.

- Provide proof of income or financial stability.

Don't worry—Sezzle makes the application process quick and painless, so you can start shopping in no time.

Tips for Maximizing Your Sezzle Experience

Now that you know who accepts Sezzle virtual card, here are a few tips to enhance your experience:

- Track Your Spending: Use the Sezzle app to monitor your purchases and payments.

- Set Payment Reminders: Stay on top of your installments with personalized alerts.

- Shop During Sales: Combine Sezzle with discounts for maximum savings.

By following these tips, you'll make the most out of your Sezzle journey.

The Future of Sezzle

As the BNPL industry continues to grow, Sezzle is poised to revolutionize the way we shop. With expanding partnerships and innovative features on the horizon, the future looks bright for both consumers and merchants alike.

Stay tuned for exciting developments, including enhanced security measures, expanded global reach, and even more retailer integrations.

Conclusion

Who accepts Sezzle virtual card? The answer is simple—virtually anyone who accepts Visa or Mastercard. From online giants to local boutiques, Sezzle is quickly becoming a staple in the shopping world. By offering flexible payments, secure transactions, and no hidden fees, Sezzle empowers consumers to shop smarter and more responsibly.

So, what are you waiting for? Sign up for Sezzle today and join the millions of shoppers who are redefining the way they pay. Don't forget to share this article with your friends and leave a comment below—your feedback means a lot to us!